There is a term for business successes that have occurred without any planning or consideration of the processes taking place inside and outside the company. That word is "coincidence." In a world of global markets, technological changes, and constant geopolitical shifts, every step must be well thought out—both months in advance and immediately before it is taken.

Financial planning is not just a series of numbers updated annually. It sets the direction for the entire company – it determines what products and services will be developed, where investments will be directed, and what specialists will be hired or dismissed. It is a process with a high level of responsibility. And now, more than ever, it is imperative that the approach to it be reviewed.

According to a KPMG study, between 60% and 80% of companies fail to implement their strategies, and fewer than 5% of employees are either unaware or do not understand that such strategies exist. These two conclusions are related. The traditional financial planning and analysis (FP&A) process is based on models from a time when it was acceptable for systems, data arrays, and entire departments not to "talk" to each other and to exchange incompatible information sporadically.

This creates significant risks of technical errors during manual entry and heavy IT dependencies due to the specific solutions that must enable each process. It is not surprising that, in a study by International Data Corporation among 370 CFOs, nearly half (46%) see a need to improve financial planning and modelling.

In many cases, information that was previously difficult to collect is not updated until the next budget is prepared.

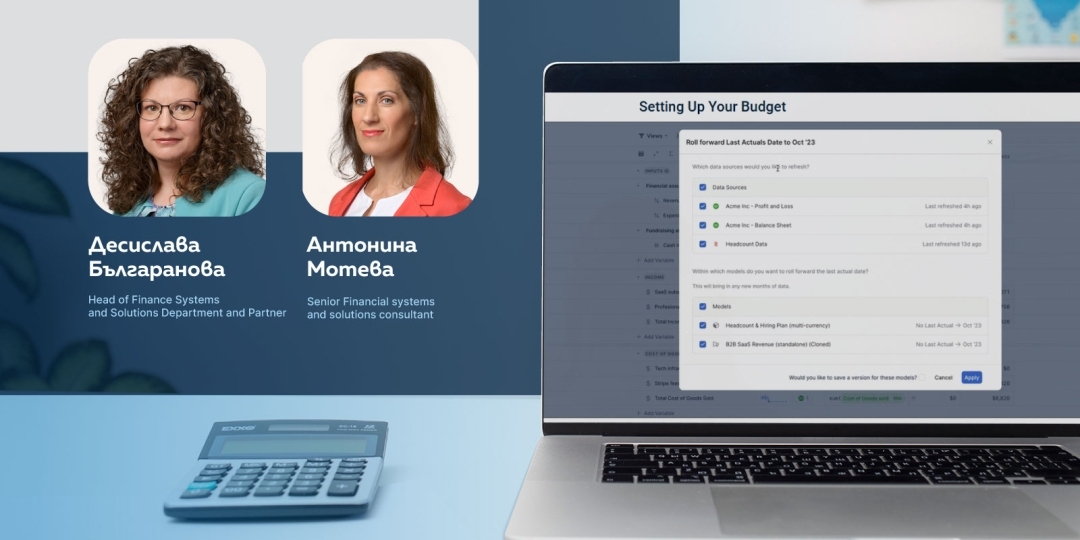

"When something remains static and resistant to change, it gradually loses its meaning, and no one pays attention to it. If you can't compare the planned budget with the actual results—and do so easily—you actually have no idea where you are and why you got there," explains Desislava Bulgaranova, Head of Finance Systems and Solutions Department and Partner at Bulgarian system integrator Balkan Services, to Money.bg.

What is xP&A?

The dynamic business environment necessitates a fresh perspective on the future. This is where the concept of extended planning and analysis (xP&A) comes in—an innovative approach to financial and operational planning and analysis. It is based on data. Information from all key departments – including finance, sales, operations, marketing, HR, and others – is consolidated and standardised in a single source, accessible in real-time. This enables modelling of different scenarios with a high degree of detail, allowing for informed decisions at any given moment.

Antonina Moteva, Managing Financial Systems and Solutions Consultant at Balkan Services, gives a concrete example of how xP&A solutions work to the benefit of the business:

"Let's assume that we are a product sales company and we understand that a competitor is lowering prices and undercutting the market. In this situation, the company must react quickly. With an xP&A solution like this, where everything is integrated in one place, it can instantly change a parameter—such as reducing prices—and immediately see the impact of that action on all other indicators."

In addition, automation eliminates dependencies on the human factor. In theory, complex planning can also be done using linked Excel files with complex formulas, but in practice, even a single incorrect value can compromise the entire process. In addition, usually only a limited number of people in the company understand how these key tables work, which makes a multimillion-dollar business "hostage" to a few files or one person. Automation eliminates this risk, ensuring security and transparency.

Collecting and unifying data in a format that is understandable and applicable to financiers is invaluable in preparing the often highly complex company budget. In this way, information—from machine hours of production equipment to the risk of losing key personnel—is transformed into metrics relevant to planning.

"The point is to provide data to financiers so that they have time for big strategic decisions. That's their job—not to collect detailed information," says Desislava Bulgaranova emphatically. She adds: "Planning is a team sport, but a united team that looks in one direction and sees the goal."

Lucanet xP&A offers a practical solution to these challenges – a proven system that is part of the Lucanet business software developer's platform and is implemented in Bulgaria by the Balkan Services consulting team.

Lucanet xP&A is a cloud-based solution with ready-made connectors for seamless integration with the most popular ERP, HR, and CRM systems. Thanks to the partnership with the manufacturer, connectors for more specific systems used in our market can also be created if necessary. The system also allows data to be fed from individual files and tables.

The planning models are created by the responsible participants in the planning and budgeting process. No software developer or additional programming by an internal IT team is needed—different versions/scenarios of the budget can be "played out" by changing the initial assumptions, which helps us see what could happen in the best or worst case scenario," adds Bulgaranova.

This IT independence is crucial in situations where sudden and rapid changes are needed – for example, at the beginning of the pandemic in 2020, crisis budgets replaced all approved company budgets, and many organisations had to develop survival scenarios.

If a model still needs to be programmed and tested, in the best-case scenario, an opportunity for greater profit will be missed; in the worst-case scenario, it could prove fatal to the business.

As part of the Lucanet ecosystem, xP&A enhances the financial planning module by enriching it with operational data.

The system, following trends, also has AI agents. Based on accumulated experience, various scenarios are presented, with AI continuing to learn and improve during the work process. With the development of generative artificial intelligence, its application in finance is expected to expand, providing more opportunities to create added value.

"The AI assistant can be used to suggest new variables to be added to the relevant model. It suggests variables and formulas completely independently, including adding new hard-coded assumptions, which are then used in its calculations," explains Antonina Moteva.

It is essential to emphasise that artificial intelligence provides recommendations, but the decision ultimately remains with the user—they choose whether to apply them directly, adapt them, or reject them.

Analyses lose much of their value without effective data visualisation. Lucanet xP&A offers a wide variety of graphs and charts designed for both top management and operational teams. A significant advantage is that the visualisations are dynamically linked to the underlying data in real time.

"When you have a visualisation in front of you, you get instant access to the parameters included. You see that profits are growing, and you can immediately drill down into the details to understand why. This way, the focus remains on strategic issues instead of wasting days preparing graphs," explains Antonina Moteva.

An additional advantage highlighted by Balkan Services is the versatility of the solution—Lucanet xP&A applies to various companies, both in terms of scale and industry.